Insights and Resources

Stay informed with our curated selection of riveting content, keeping you at the forefront of market trends and developments.

Get in touch

The New Valuation Reality in Food & Beverage

The Reset, the Shift, and the Opportunity 📉

The food and beverage sector has undergone a fundamental repricing since 2021, establishing a new valuation baseline that reflects structural changes in how markets price profitability, margin quality, and sustainability. This analysis examines the implications for strategic positioning and value creation.

I. The Structural Reset: Understanding the New Baseline

The Valuation Rebase (2021-2025)

Since 2021, the sector has experienced a valuation reset that represents a permanent shift in market expectations:

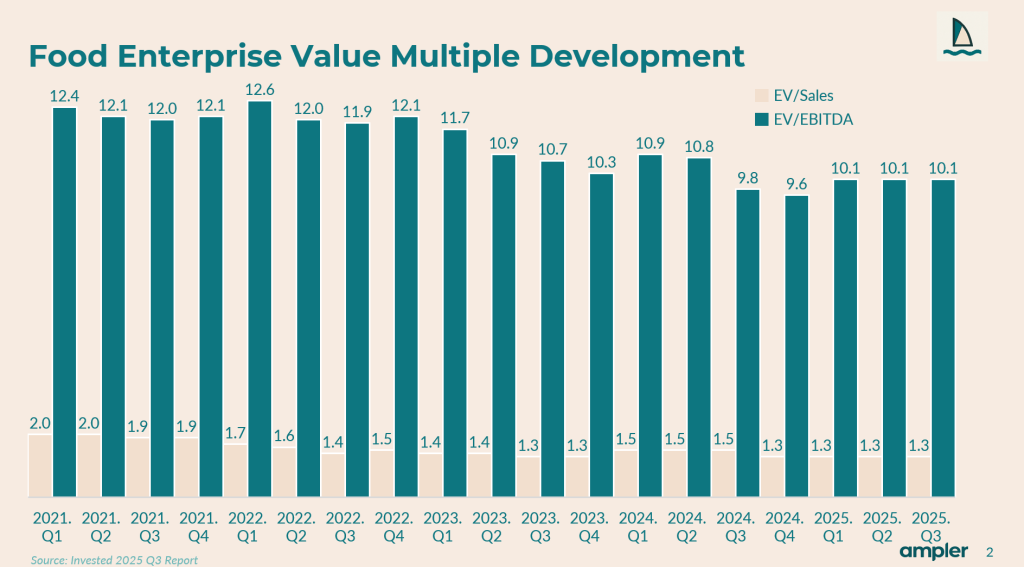

Food Sector:

- EBITDA multiples for public firms declined from 12.6x to 10.1x – 20% compression

- EV/Sales stabilized at 1.3x for 4 consecutive quarters

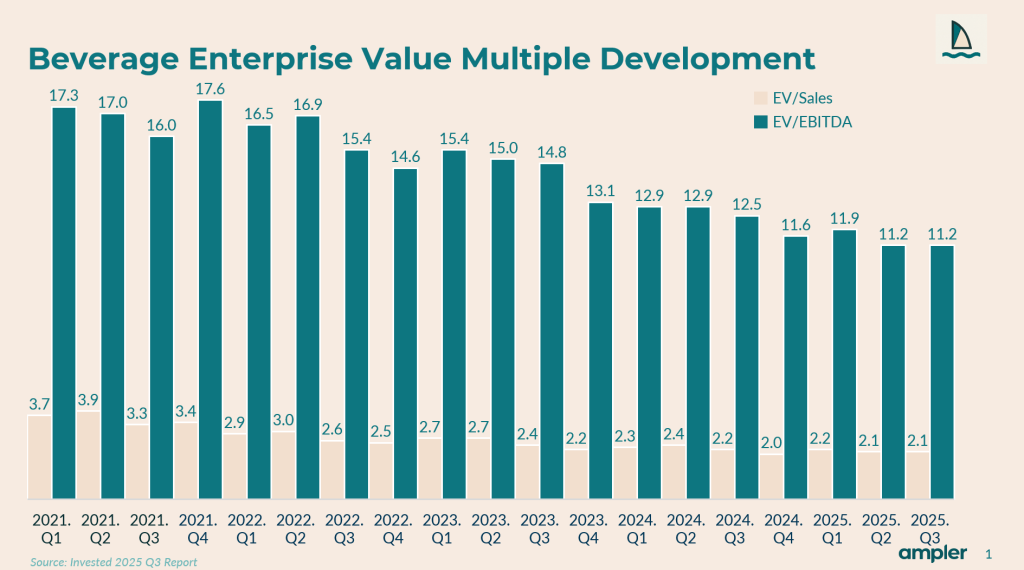

Beverage Sector:

- EBITDA multiples for public firms declined from 17.6x to 11.2x – 36% compression

- EV/Sales declined from 3.9x to 2.1x

The beverage sector’s steeper fall reflects its higher 2021 starting point—it was more overvalued during the post-pandemic premium era, commanding multiples that assumed higher and longer growth in premium coffee, energy drinks, and functional beverages. When interest rates rose and consumer spending normalized, these assumptions unwound faster and harder than in food.

Why This Matters

The 2022-2023 inflection point marked the end of the post-pandemic valuation premium era. Markets now treat operational discipline and sustainability data as risk-pricing factors rather than differentiators. The compression wasn’t driven by temporary weakness—it reflected a fundamental reassessment of what constitutes sustainable profitability in an environment of persistent inflation, evolving consumer preferences toward sustainability, and increased scrutiny of ESG metrics by lenders and acquirers.

The plateau in Food EV/Sales at 1.3x for four consecutive quarters signals market stabilization. We’re no longer in a correction phase.

II. The New Value Equation: What Drives Premium Multiples

Multiples Are Earned, Not Given

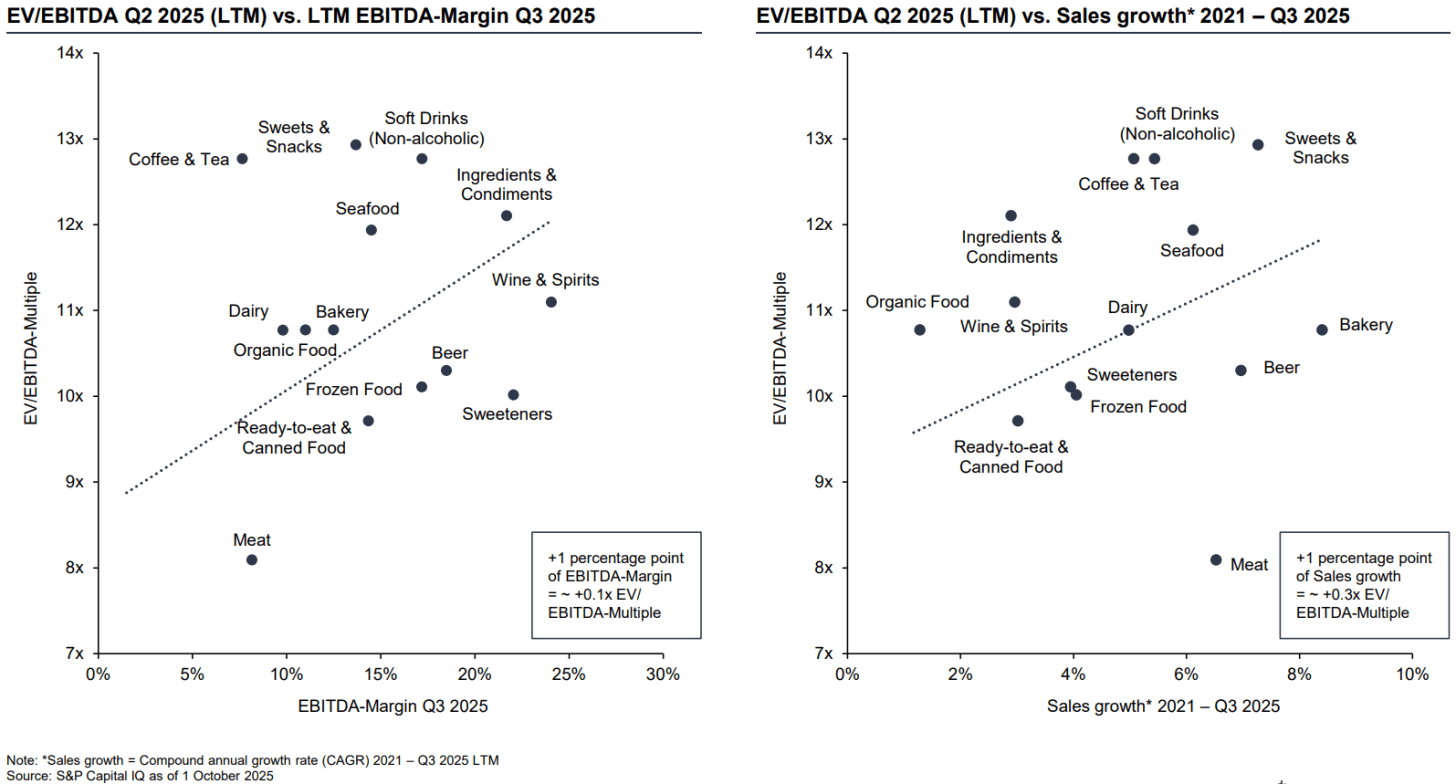

In the post-2021 environment, premium valuations require businesses to demonstrate operational discipline, tight cost control, resilient supply chains, and credible sustainability credentials. The data reveals specific quantifiable relationships:

Margin Power = Multiple Power

- Each percentage point of sales growth (CAGR) correlates with approximately +0.3x EV/EBITDA multiple

- Each additional percentage point of EBITDA margin correlates with approximately +0.1x EV/EBITDA multiple

III. Three Strategic Dynamics Reshaping the Sector

1. The Margin Reality: Why Indulgence Outprices Nutrition

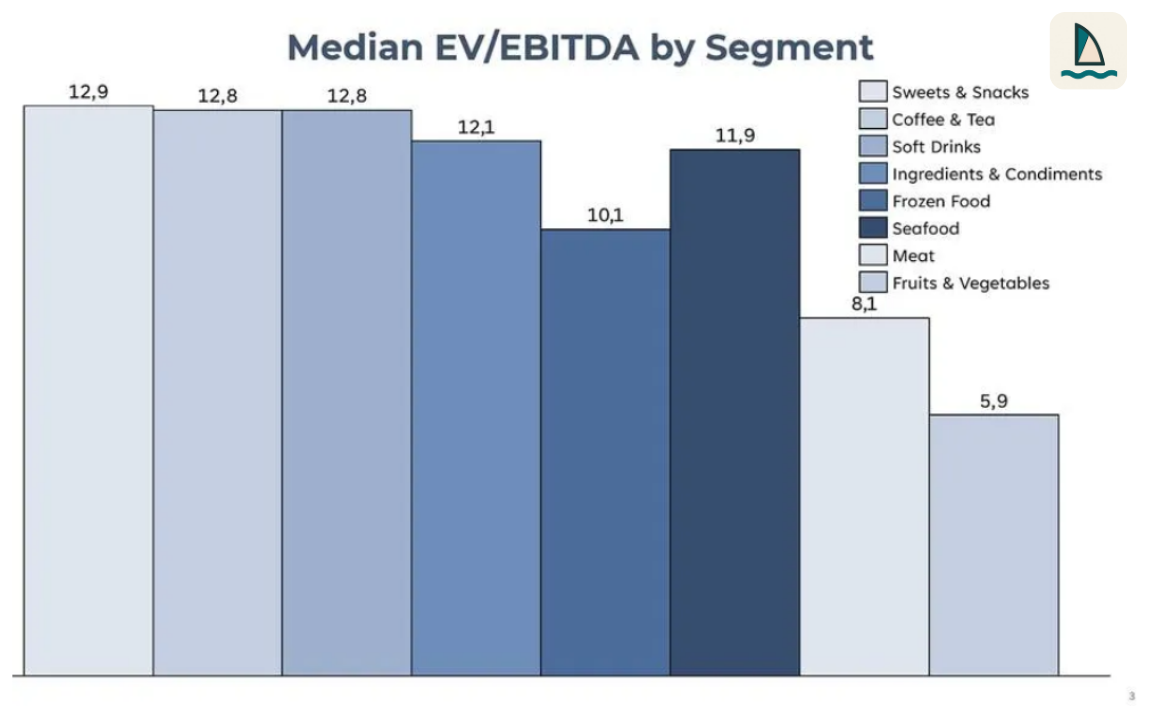

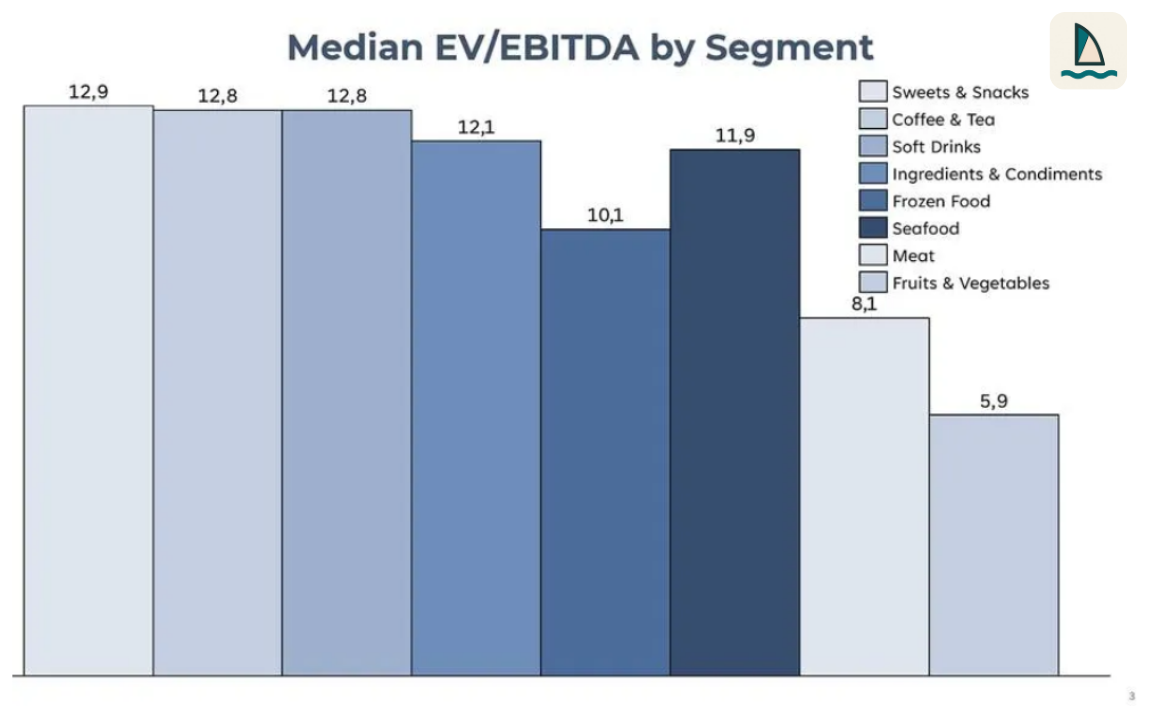

The highest multiples sit in Sweets & Snacks and Coffee & Tea segments, while the lowest valuations are in Fruits & Vegetables and Meat. This isn’t paradoxical—it’s the natural outcome of how consumers actually spend money.

Why This Occurs:

Premiumization potential: Consumers trade up in coffee and confectionery more readily than in staples. A €7 artisanal chocolate bar is an affordable indulgence; a €12 premium chicken breast is a grocery budget decision.

Margin structure: Premium chocolate and specialty coffee transform low-cost inputs into high-value products. A €2 bag of coffee cherries becomes a €12 bag of artisanal beans; cocoa pods become craft chocolate bars selling for multiples of input cost. Shelf stability and brand storytelling amplify this advantage. Fresh produce and commodity meat face structural constraints: perishability limits pricing power, cold chain costs erode margins, and the product remains largely unchanged from farm to table.

Innovation velocity: Sweets and beverages support continuous new product development cycles with faster payback. Limited edition flavors, seasonal releases, and functional innovation keep consumers engaged and willing to pay premium prices.

The market rewards willingness-to-pay, not nutritional necessity. Companies in commodity categories must either build brand equity that creates pricing power (organic certification, origin stories, regenerative agriculture claims) or achieve scale advantages that enable margin expansion through efficiency. Nutritional virtue alone doesn’t command premium valuations.

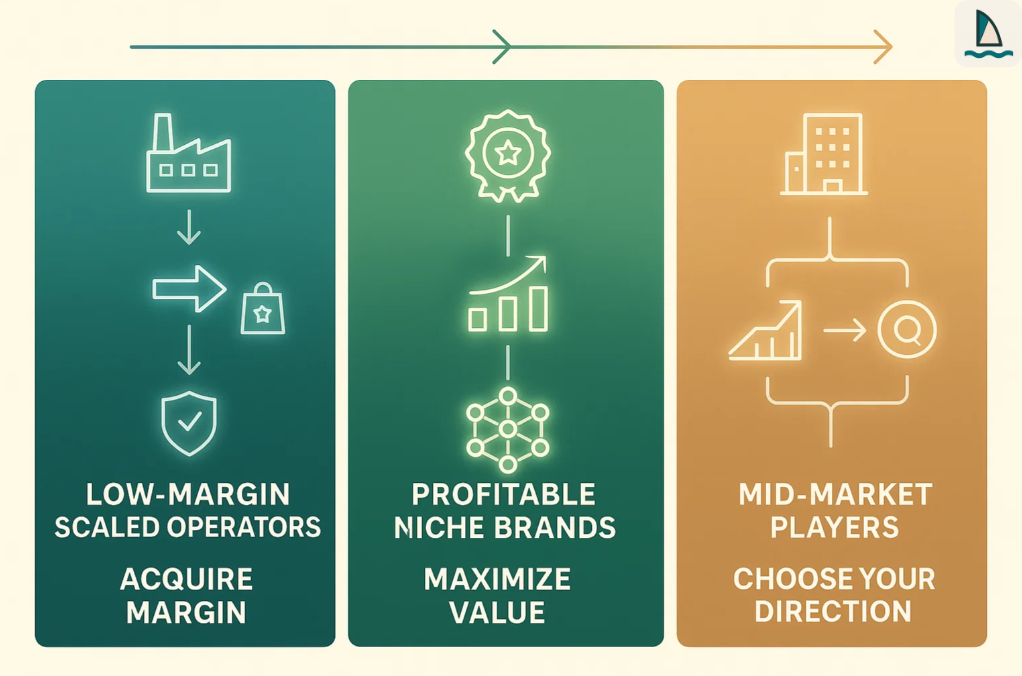

2. Consolidation as Strategy: The Margin Acquisition Thesis

M&A activity remains concentrated in resilient segments, including convenience food, ingredients, bakery, and dairy, with distinct strategic patterns. Both strategic buyers and financial sponsors are hunting for the same thing: margin and growth in brands that can scale.

The Playbook:

- Acquiring premium, functional, and niche brands to rebalance portfolios

- Divesting commoditized, low-margin categories

- Using bolt-on acquisitions to achieve critical mass in growth segments

The Two-Tier Market:

If you’re a profitable niche brand, you’re sitting in the acquisition crosshairs. Most of our audience sits here—congratulations, but position carefully. If you’re scaled in low-margin segments, you must acquire to move up the value chain or risk becoming a perpetual cost-cutter with declining multiples.

3. Selective Recovery: Who Captures the Next Growth Phase

While the broad market has stabilized at its new baseline, subsector divergence is accelerating. Specific segments show upward momentum that signals where capital is flowing:

Coffee & Tea: Resilient demand with premiumization (median 12.8x EBITDA) – up 20% from a year ago

Sweets & Snacks: Sustained pricing power (median 12.9x EBITDA) – also up ~20% from a year ago

Growth is returning, but only for operators positioned to capture it.

IV. The Sustainability Imperative: From Marketing to Deal Structure

Here’s where M&A strategy and sustainability converge in ways that directly impact valuation. Credible sustainability data is now embedded in deal structures, banking covenants, and due diligence processes. This is about risk pricing.

A Fundamental Shift

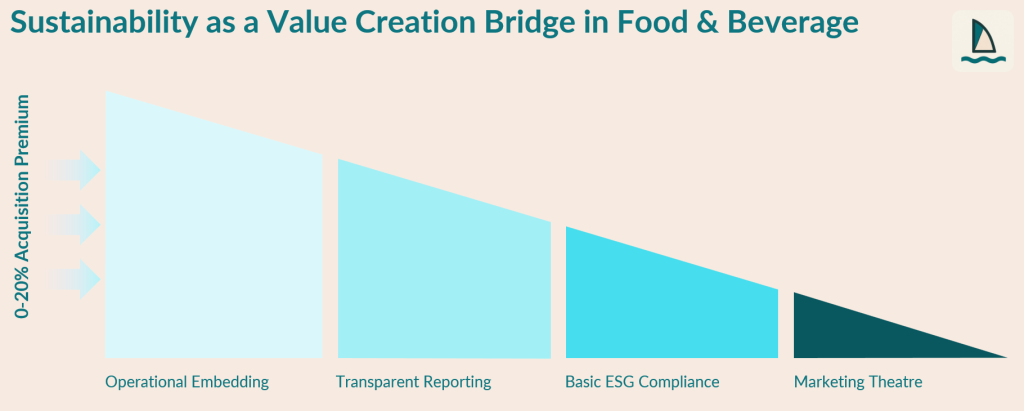

Lenders and buyers now treat sustainability as a quantifiable risk factor. Banking covenants increasingly incorporate ESG metrics and sustainability targets. Acquisition due diligence includes supply chain emissions audits. Premium multiples accrue to businesses with transparent, auditable sustainability programs, while discounts apply to those without—quietly but consistently.

Where This Creates Value:

Regenerative agriculture: Farms demonstrating soil health improvements command premiums in acquisition discussions.

GHG transparency: Companies with supply chain visibility reduce financing costs. Scope 3 emissions data is particularly coveted.

Circular packaging: Brands with closed-loop systems attract purpose-driven acquirers willing to pay for proven environmental credentials.

Carbon neutrality pathways: Clear decarbonization roadmaps reduce long-term risk perception and lower cost of capital.

Sustainability must be operationally embedded, not marketing theater. Investors distinguish between genuine transformation and greenwashing.

If you’re curious about the difference in practice, reach out to us at iliane@argo-advisory.com

V. Positioning for Value Creation

For Low-Margin, Scaled Operators

Your Challenge: You’re competing in commoditized segments (meat, produce, basic dairy) where multiples have compressed. Simply cutting costs won’t reposition you for premium valuation.

Your Pathway:

1. Acquire margin: Target niche brands with 15%+ EBITDA margins in adjacent categories

2. Build brand moats: Invest in organic, grass-fed, or origin-authenticated SKUs that resist commoditization

3. Vertical integration: Control critical supply chain nodes to capture more gross margin

4. Operational transformation: Deploy automation and data analytics to drive efficiency gains that fund brand investment

For Profitable Niche Brands

Your Opportunity: You’re in the acquisition crosshairs of both strategic buyers and financial sponsors seeking to buy margin and growth.

Your Maximization Strategy:

- Document sustainability: Build auditable ESG credentials that reduce buyer risk perception and support premium valuation

- Demonstrate scalability: Show that your margins hold or expand with volume growth

- Diversify distribution: Reduce dependency on any single channel or customer

- Build management depth: Reduce key person risk through strong teams—this becomes critical during late-stage due diligence and price negotiations

Better-For-You Positioning: Companies focusing on clear health benefits, sustainable practices, and natural ingredients are commanding higher demand and valuations. This is a structural shift in consumer behavior that’s accelerating, creating opportunities in:

· Functional foods & beverages: Products with documented health benefits (protein, probiotics, adaptogens) trade at premiums to basic nutrition

· Transparency & traceability: Brands that can authenticate origin, process, and impact from farm to shelf are building moats that traditional CPG cannot easily replicate

For Mid-Market Players at Risk

Your Reality: Too large for niche premiums, too small for scale efficiencies. You must move decisively to scale up through acquisition, specialize in building brand equity, or prepare for sale. And start focusing on sustainability yesterday—it’s no longer optional for competitive positioning.

VI. Operating from the New Baseline

The food and beverage sector has completed its valuation reset. We’re not waiting for a recovery to 2021 levels—those levels represented an unsustainable premium environment. The broad market has stabilized, but subsector divergence is creating clear winners and losers.

The New Reality:

Multiples are earned through demonstrated operational excellence, margin quality, and sustainability performance. Subsector selection matters: indulgence categories structurally outperform commoditized nutrition. Selective recovery favors those who adapt quickly and position strategically.

The next wave of premium valuations will accrue to businesses that combine operational sharpness, delivering consistent margin expansion, sustainability credentials that withstand investor scrutiny, and category positioning in segments with structural tailwinds—health, convenience, and premiumization.

The question is about who adapts quickly enough to avoid drifting into commodity status, and who builds the next premium by pairing operational excellence with sustainability that actually stands up to investor scrutiny.

Reach out at office@argo-advisory.com – we’d love to hear from you.

Sources:

- S&P Capital IQ: Valuation multiples based on global publicly traded F&B companies

- Investec Food & Beverage M&A and Valuation Update Q3 2025: https://www.investec.com/advisory/wp-content/uploads/2025/11/Investec-FB-MA-and-Valuation-Update-Q3-2025.pdf

Footnote: The valuation multiples referenced in this article are derived from publicly listed companies within the sector. When estimating the value of a privately held company, it is important to account for factors such as illiquidity, limited marketability, and higher perceived risk. These considerations typically result in private companies trading at a material discount relative to their publicly traded peers.

Argo Advisory | Published: December 2025